The United Arab Emirates, and Dubai, in particular, is an attractive destination for entrepreneurs and investors all over the globe. Dubai can be considered the MENA region’s business hub with excellent global connectivity, state-of-the-art infrastructure, and a business-friendly environment. All of this makes the idea of company formation in Dubai seem like a sound business proposition. However, a lack of understanding of the costs involved for business setup in Dubai can lead to inconvenient and excessive overheads.

Here are some of the most pertinent questions you need to be asking about company formation in Dubai :

- Where should I setup a company in Dubai?

- How can I calculate approximately the funds required for a business setup in Dubai?

- Which freezone in Dubai offers the cheapest company setup options?

- Is it possible to establish a low-investment business in Dubai?

- Do I need to pay for a Dubai trade license cost in advance?

- How much does it cost for a Limited Liability Company (LLC) formation in Dubai?

- What are the various payments charged by the government for business setup in Dubai?

- Are there any affordable business solution providers in Dubai or cheap business setup services in Dubai?

The fact is Dubai company formation cost keeping changing over time since the government can increase or decrease the fees for the various processes involved at any time. Therefore, it will be challenging to compute a fixed rate for various approvals. The best option is to reach out to a knowledgeable and affordable business setup consultants in Dubai like Avyanco. We can help investors/entrepreneurs become aware of the charges levied initially and update them on variations in judicial prices and other governmental services. An experienced business setup consultant will be able to guide and advise investors on probable expenditures, thereby saving them from incurring unnecessary expenses.

Costs of setting up a business in Dubai

The cost of setting up a business in Dubai depends on factors such as the type of business activity, the jurisdiction under which the company falls, and the approvals and certifications required. Leveraging years of helping entrepreneurs with the company setup in Dubai, Avyanco has created a list of costs based on current and standard business setup expenses in Dubai.

The prices have been calculated based on the two main categories – Mainland and Free Zone.

Cost of Opening a Company in Dubai, Rakez, Sharjah Freezone

Setting up a business in the UAE has inherent cost-saving advantages, such as tax benefits, strategic locations, and a thriving economy, compared to the other countries, making it a popular option for business setup in the UAE.

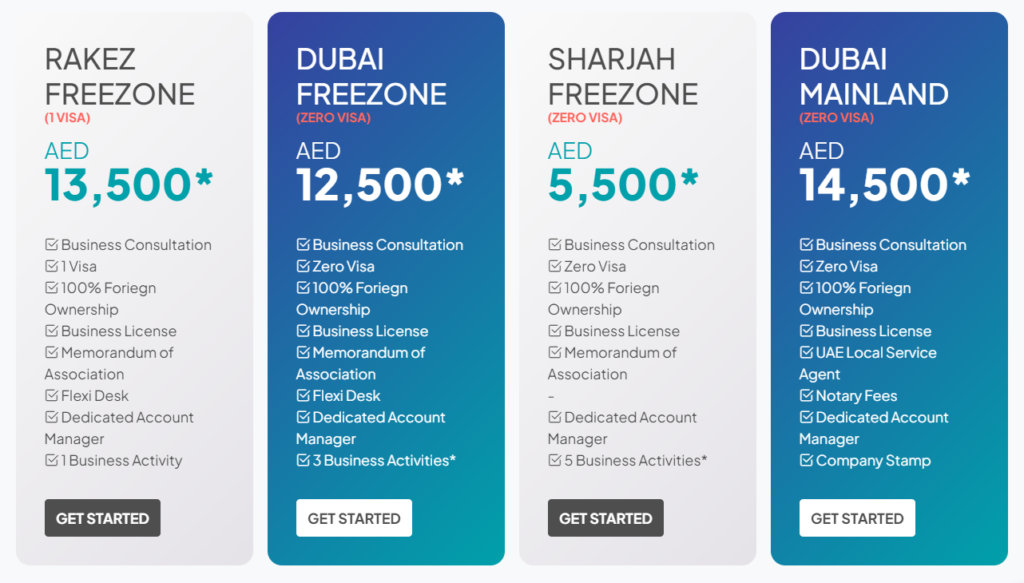

The cost of a Freezone business license varies based on different locations. The major free zone business setup costs are listed below.

- Sharjah Media City Freezone (SHAMS) start with AED 5,500/-

- Dubai Freezone – IFZA starts with AED 12,500/-

- Dubai Freezone – DUQE starts with AED 12,500/-

- Dubai Freezone – MEYDAN starts with AED 12,500/-

- RAKEZ Freezone – Business License + 1 Lifetime Visa starts with AED 16,500/-

It is always better to check with business setup consultants prior to process the application as most of the time there will be promotion on company setup in various freezones.

Cost of Company Formation in Dubai Mainland

Like freezone, the costs of setting up a company in Dubai Mainland depend on factors such as the nature of the business, number of visas, and premises.

- Initial Approval in DED (Department of Economic Development) AED 235 (One-time cost)

- Approval of trade name – AED 735 (One-time cost)

- Office rent – depends on the size of your office. Average office rent would be AED 50 and above per sq. feet per annum. Office rent depends on location and required area.

- Attestation of Memorandum of Association (MoA) – AED 1200 (One-time cost); to be drawn up and approved by all partners of the company

- Drafting of contract and court agreement attestation – AED 500 for typing (One-time cost); all the partners or their attorneys will need to go sign the court agreement attestation

- Registration with Ministry of Economy – AED 3,000 (One-time cost); your company will be registered upon the payment of this fee.

- Trade license fee – AED 10000 Approx.

- Market fees – to the government as a percentage of the office rent – 5% of the rent for shops, 20% of the rent for warehouses.

Above, we shared a detailed distribution of the company formation cost in Dubai Mainland; however, the cost of setting up a company in Dubai Mainland ranges between AED 14,500 and AED 25,000.

How to Keep Costs Down While Starting a Business in Dubai

The easiest way to keep costs down while starting a business in Dubai is to call upon the services of experienced, expert business setup consultants like Avyanco. We are one of the leading business setup consultancy firms in Dubai. Avyanco prides itself in offering the most cost-effective business setup services for the UAE market.

How Avyanco Business Setup Can Help You – Through FAQs?

It is always recommended to consult with an expert business setup advisor that can help you understand the whole business setup process. Avyanco makes sure to make the company formation in Dubai as simple as possible.

Is It Easy To Open A Company in Dubai?

In short – yes! Company formation in Dubai becomes effortless when you consult with the right business setup advisor like Avyanco. Team Avyanco is all and well capable of handling the entire company setup process for you.

How to Keep Costs Down while Starting a Business in Dubai?

The easiest way to keep costs down while starting a business in UAE is to call upon the services of experienced business setup consultants like Avyanco. We assist you throughout the process along with offering you multiple packages that best meet your requirements and budget.

What Is The Mainland Company Setup Cost in Dubai?

The cost of mainland company formation in Dubai ranges between AED 15,000 – AED 35,000. However, it may vary based on several factors like the license type, size, type of business, business activity, and more.

What Is The Dubai Free Zone Company Setup Cost?

Dubai free zone company setup cost ranges AED 10,000 – AED 30,000; nevertheless, it may vary based on multiple factors such as size and type of business, type of business license, type of free zone, and more.

How Avyanco Can Help You Starting a Business in Dubai?

With years of industry experience and a varied portfolio under our belt, Avyanco takes pride in saying that we are the leading business setup consultants in Dubai. We have helped thousands of foreigners in setting up businesses in Dubai.

Team Avyanco assists investors in company formation in Dubai offering them the best tailored packages. Join hands with us and let us make the endeavor seamless for you.

Contact Avyanco & allow our experts to helping with the most optimally-priced business set up in Dubai. Call/WhatsApp: +971 50 3989000, (T): +971 4 240 5000, Email: info@avyanco.com